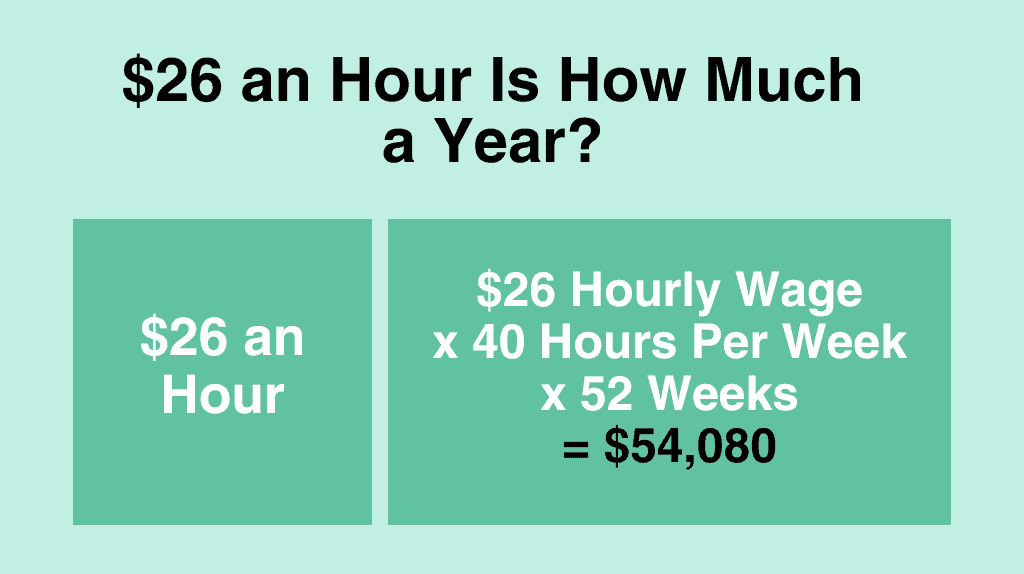

Are you wondering how much $26 an hour is in a year? If you’re considering a job that pays $26 an hour, it’s important to know how much you’ll make annually. While the answer may seem straightforward, there are a few factors to consider, such as the number of hours you work per week and the number of weeks you work per year.

Assuming a 40-hour workweek and working 52 weeks a year, a $26 hourly wage equates to approximately $54,080 per year. This is just a rough estimate, as your actual salary may vary depending on your employer and specific job duties. It’s important to keep in mind that this figure also doesn’t take into account any additional benefits or bonuses you may receive as part of your compensation package.

Convert $26 Per Hour to Weekly, Monthly, and Yearly Salary

$26 an Hour is How Much a Year?

If you make $26 an hour, your annual salary would be $54,080. We calculate your annual salary based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hourly Wage ($26) x Hours Worked per Week (40) x Weeks Worked per Year (52) = $54,080

$26 an Hour is How Much a Month?

If you make $26 an hour, your monthly salary would be $4,507. We calculate your monthly salary by dividing your annual salary by 12 months.

Hourly Wage ($26) x Hours Worked per Week (40) x Weeks Worked per Year (52) / Months per Year (12) = $4,507

$26 an Hour is How Much Biweekly?

If you make $26 an hour, your biweekly salary would be $2,080. We calculate your biweekly salary based on 8 hours per day, 5 days per week.

Hourly Wage ($26) x Hours Worked per Week (40) x Number of Weeks (2) = $2,080

$26 an Hour is How Much Weekly?

If you make $26 an hour, your biweekly salary would be $1,040. We calculate your weekly salary based on 8 hours per day, 5 days per week.

Hourly Wage ($26) x Hours Worked per Week (40) = $1,040

$26 an Hour is How Much Daily?

If you make $26 an hour, your biweekly salary would be $208. We calculate your daily salary based on 8 hours per day.

Hourly Wage ($26) x Hours Worked per Day (8) = $208

$26 an Hour is How Much a Year After Taxes?

Federal Income Tax

When calculating your yearly income after taxes, one of the most important factors to consider is federal income tax. This tax is based on your total income for the year, and the amount you owe will depend on your tax bracket. Here’s a breakdown of the federal income tax brackets for 2023:

| Tax Rate | Single Filers |

|---|---|

| 10% | $0 to $11,600 |

| 12% | $11,001 to $44,725 |

| 22% | $44,726 to $95,375 |

| 24% | $95,376 to $182,100 |

| 32% | $182,101 to $231,250 |

| 35% | $231,251 to $578,125 |

| 37% | $578,126 or more |

To calculate your federal income tax, you’ll need to determine which tax bracket you fall into based on your total income. Then, you can use the corresponding tax rate to calculate your tax liability.

For example, if you are single and you earn $54,080 per year at a rate of $26 per hour, this means you would owe $7,205 in federal income tax for the year.

Estimated federal income tax (single filers) = $7,205

State Income Tax

While nine states do not impose their own income tax for tax year 2024, the majority of states do.

State income tax rates vary widely across the United States, ranging from 0% to over 13%. To help you estimate your take-home pay after state income tax, we’ve compiled a chart of state income tax rates for all 50 states.

| State | State Income Tax Rate |

|---|---|

| Alabama | 2% – 5% |

| Alaska | 0% |

| Arizona | 2.59% – 4.50% |

| Arkansas | 0.9% – 6.6% |

| California | 1% – 13.30% |

| Colorado | 4.55% |

| Connecticut | 3% – 6.99% |

| Delaware | 0% |

| Florida | 0% |

| Georgia | 1% – 5.75% |

| Hawaii | 1.40% – 11% |

| Idaho | 1.125% – 6.925% |

| Illinois | 4.95% |

| Indiana | 3.23% |

| Iowa | 0.33% – 8.53% |

| Kansas | 3.10% – 5.70% |

| Kentucky | 2% – 5% |

| Louisiana | 2% – 6% |

| Maine | 5.00% |

| Maryland | 2% – 5.75% |

| Massachusetts | 5.00% |

| Michigan | 4.25% |

| Minnesota | 5.35% – 9.85% |

| Mississippi | 0% – 5% |

| Missouri | 1.5% – 5.4% |

| Montana | 1% – 6.9% |

| Nebraska | 2.46% – 6.84% |

| Nevada | 0% |

| New Hampshire | 5% |

| New Jersey | 1.4% – 10.75% |

| New Mexico | 1.7% – 4.90% |

| New York | 4% – 8.82% |

| North Carolina | 5.25% |

| North Dakota | 1.10% – 2.90% |

| Ohio | 0% – 4.797% |

| Oklahoma | 0.5% – 5% |

| Oregon | 4.75% – 9.90% |

| Pennsylvania | 3.07% |

| Rhode Island | 3.75% – 5.99% |

| South Carolina | 0% – 7% |

| South Dakota | 0% |

| Tennessee | 0% |

| Texas | 0% |

| Utah | 4.95% |

| Vermont | 3.35% – 8.75% |

| Virginia | 2% – 5.75% |

| Washington | 0% |

| West Virginia | 3% – 6.5% |

| Wisconsin | 4% – 7.65% |

| Wyoming | 0% |

As you can see, state income tax rates vary significantly. It’s important to check the state income tax rate for your state to get an accurate estimate of your take-home pay.

For example, if you live in Colorado with a flat 4.55% tax rate, your estimated state tax is $2,461.

Gross Income ($54,080) x State Income Tax (4.55%) = $2,461

Local Taxes

Local taxes can vary widely depending on where you live and work, so it’s important to research and understand the local tax laws in your area.

Here’s a table that shows the local income tax rates for some of the largest cities in the United States:

| City | Local Income Tax Rate |

|---|---|

| New York City | 3.88% |

| Los Angeles | 1.5% |

| Chicago | 4.95% |

| Houston | 0% |

| Phoenix | 0% |

| Philadelphia | 3.87% |

| San Antonio | 0% |

| San Diego | 0% |

| Dallas | 0% |

| San Jose | 0.94% |

As you can see, local income tax rates can vary widely, with some cities having no local income tax at all. It’s important to factor in these local taxes when calculating your take-home pay, as they can have a significant impact on your overall earnings.

For example, if you live in Los Angeles with 1.5% local tax rate, your estimated state tax is $811.

Gross Income ($54,080) x State Income Tax (1.5%) = $811

FICA Taxes (Social Security & Medicare)

FICA taxes consist of Social Security and Medicare taxes, which are mandatory contributions to support these programs.

The current FICA tax rate is 15.3%, with 6.2% for the employer’s portion of Social Security and 6.2% for the employee’s portion. Additionally, 1.45% is allocated for the employer’s portion of Medicare and 1.45% for the employee’s portion.

To calculate your FICA taxes, you can use a FICA tax calculator. These calculators take into account your income, filing status, and other factors to determine your FICA tax liability. It’s important to note that FICA taxes are only applicable to income up to a certain amount.

For the year 2024, the Social Security wage base is $168,600, meaning that any income earned above this amount is not subject to Social Security taxes.

If you are earning $26 an hour, your estimated FICA taxes is $4,137.

Gross Income ($54,080) x FICA Tax (6.2% + 1.45%) = $4,137

Calculating Your After-Tax Salary

If you are earning $10 an hour, you may be wondering how much your total after-tax salary would be. Calculating your after-tax salary can be a bit tricky, but it’s important to know how much money you will actually take home.

Estimated Federal Tax: $7,205

Estimated State Tax: $2,461

Estimated Local Tax: $811

Estimated FICA Tax: $4,137

Total Estimated Tax: $14,614

To calculate your take-home pay, you take your gross salary and subtract your total estimated tax. Your actual take-home pay may vary depending on your filing status and your deductions.

Gross Income ($54,080) – Total Estimated Tax ($14,614) = $39,466

Is $26 an Hour Good?

If you make $26 an hour, you may be wondering if it is a good wage. The answer depends on your personal financial situation and your location. However, here are some factors to consider:

National Average

According to the Bureau of Labor Statistics, the median hourly wage for all workers in the United States is $19.14. Therefore, earning $26 an hour places you above average. You are making more than 59% of workers in the country.

Annual Salary

If you work 40 hours a week for 50 weeks a year, your annual salary would be approximately $52,000 before taxes. This amount may vary depending on your deductions, location, and other factors.

Cost of Living

The cost of living varies greatly depending on where you live. In some areas, $26 an hour may be considered a high wage, while in others, it may be barely enough to cover basic expenses. It’s important to research the cost of living in your area and factor that into your decision.

Career Field

Your career field can also impact whether $26 an hour is a good wage. In some industries, such as retail or food service, it may be considered a high wage, while in others, such as finance or technology, it may be considered low. It’s important to research the average wage for your career field and compare it to your own.

Overall, earning $26 an hour places you above average in terms of hourly wage. However, whether it is a good wage for you depends on your personal financial situation and location.

Budget Plan for $26 an Hour Salary

If you earn $26 an hour, you can expect to make around $54,080 per year before taxes. It’s important to have a budget plan in place to ensure you can cover your expenses and save some money each month.

Fixed Expenses

Fixed expenses are expenses that stay the same each month. These may include:

- Rent/mortgage

- Car payment

- Insurance premiums

- Utilities (electricity, water, gas, internet, etc.)

- Phone bill

Make a list of your fixed expenses and add up the total. This will give you an idea of how much you need to earn each month to cover these expenses.

Variable Expenses

Variable expenses are expenses that can change from month to month. These may include:

- Groceries

- Dining out

- Entertainment

- Clothing

- Travel

Make a list of your variable expenses and estimate how much you typically spend on each one per month. Add up the total and add it to your fixed expenses to get your total monthly expenses.

Savings

It’s important to save some money each month. Aim to save at least 10% of your income. This can be for emergencies, future expenses, or long-term goals like retirement.

Budgeting Tips

Here are some tips to help you stick to your budget:

- Use a budgeting app or spreadsheet to track your expenses

- Look for ways to reduce your expenses, such as cutting back on dining out or finding cheaper alternatives for entertainment

- Avoid impulse purchases by making a shopping list and sticking to it

- Plan ahead for big expenses, such as holidays or car repairs, by setting aside money each month

By following a budget plan, you can make the most of your $26 an hour salary and ensure you’re on track to meet your financial goals.

How Can You Increase Your Income if $26 an Hour is Not Enough?

If you find that your current hourly wage of $26 is not enough to meet your financial goals, there are several ways to increase your income. Here are some options to consider:

1. Ask for a Raise

One of the simplest ways to increase your income is to ask for a raise. Before you approach your employer, do some research to determine the average salary for your position in your area. You can use online resources or consult with a recruiter or career coach to get an idea of what you should be earning. When you ask for a raise, be prepared to explain why you deserve it and provide examples of your accomplishments and contributions to the company.

2. Look for a Higher-Paying Job

If your employer is not willing to give you a raise, or if you are ready for a new challenge, you may want to consider looking for a higher-paying job. Research job openings in your field and consider applying for positions that offer a higher salary or better benefits. You can also network with colleagues and attend industry events to make connections and learn about new opportunities.

3. Develop New Skills

Another way to increase your earning potential is to develop new skills that are in demand in your industry. Consider taking courses or attending workshops to learn new software programs, languages, or other skills that can make you more marketable to employers. You can also volunteer for projects at work that allow you to learn new skills and demonstrate your value to the company.

4. Start a Side Hustle

If you have a talent or hobby that you can turn into a business, consider starting a side hustle. You can offer your services as a freelancer or consultant, sell products online, or start a blog or podcast that generates income through sponsorships or advertising. Starting a side hustle can be a great way to earn extra income and explore new career opportunities.

Conclusion

In conclusion, knowing how much $26 an hour is in a year can be helpful when making financial decisions. Based on the calculations, a $26 hourly wage can result in a gross income of $54,080 per year before taxes, insurance, and other deductions.

It’s important to note that the actual amount of take-home pay will depend on various factors, such as your tax bracket, state of residence, and any benefits or deductions you may have. Therefore, it’s recommended to consult with a financial advisor or use online calculators to get a more accurate estimate of your net income.

While $26 an hour is above average, it may or may not be enough to cover all your expenses and financial goals, especially if you have dependents or a high cost of living. Therefore, it’s essential to create a budget and prioritize your spending to ensure you are living within your means and saving for the future.

Frequently Asked Questions

What is the net income for someone making $26 an hour annually after taxes?

The net income for someone making $26 an hour annually after taxes depends on various factors such as the state you live in, your filing status, and deductions. However, assuming a standard deduction and a single filing status, your net income would be approximately $42,000.

How much would someone make monthly with an hourly wage of $26?

Assuming you work 40 hours a week for 52 weeks, your monthly income would be approximately $4,500 before taxes.

Is $26 an hour considered a good wage?

Yes, an hourly wage of $26 is considered a good wage. It is above the median hourly wage in the United States and can provide a comfortable living.