If you’re considering a job offer or wondering if your current salary is competitive, you may want to know how much $50,000 a year is in terms of hourly pay. Knowing your hourly wage can help you budget your expenses, plan for retirement, and negotiate a raise.

$50,000 a year translates to roughly $24 per hour, assuming a 40-hour workweek and 52 workweeks per year. However, keep in mind that your actual hourly wage may vary depending on factors such as overtime pay, bonuses, and benefits. It’s also important to consider the cost of living in your area and the industry standards for your job.

Convert $50,000 Per Year to Hourly, Daily, Weekly, and Monthly Salary

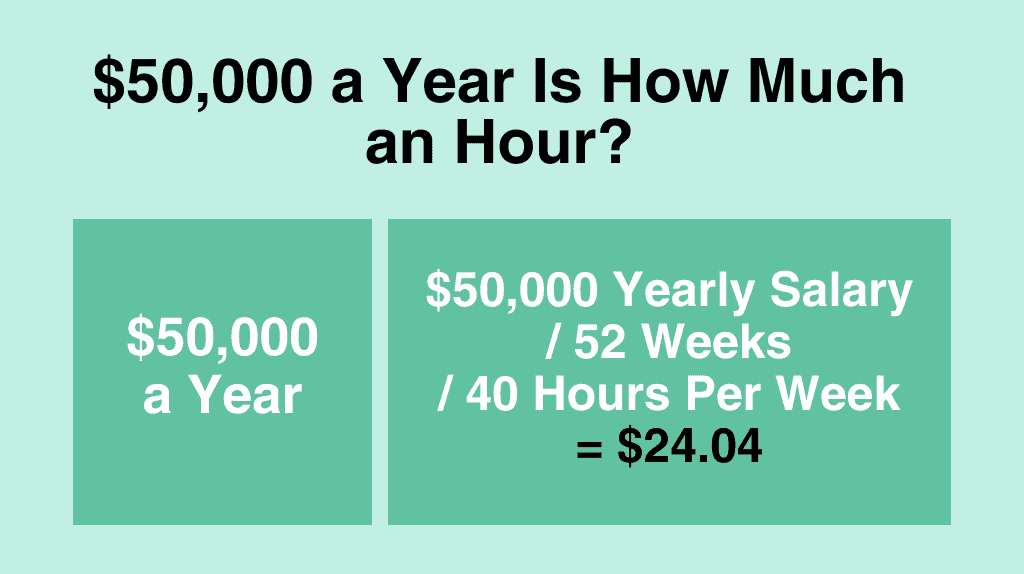

$50,000 Per Year is How Much an Hour?

If you make $50,000 an hour, your hourly salary would be $24.04. We calculate your hourly salary based on 8 hours per day, 5 days per week and 52 weeks in the year.

Annual Salary ($50,000) / Weeks Worked per Year (52) / Hours Worked per Week (40) = $24.04

$50,000 Per Year is How Much a Month?

If you make $50,000 an hour, your monthly salary would be $4,167. We calculate your monthly salary by dividing your annual salary by 12 months.

Annual Salary ($50,000) / Months per Year (12) = $4,167

$50,000 Per Year is How Much Biweekly?

If you make $50,000 an hour, your biweekly salary would be $1,923. We calculate your biweekly salary based on 52 weeks per year.

Annual Salary ($50,000) / Weeks Worked per Year (52) x Number of Weeks (2) = $1,923

$50,000 Per Year is How Much Weekly?

If you make $50,000 an hour, your weekly salary would be $962. We calculate your weekly salary based on 52 weeks per year.

Annual Salary ($50,000) / Weeks Worked per Year (52) = $962

$50,000 Per Year is How Much Daily?

If you make $50,000 an hour, your daily salary would be $192. We calculate your daily salary based on 5 days per week and 52 weeks in the year.

Annual Salary ($50,000) / Weeks Worked per Year (52) / Days per Week (5) = $192

$50,000 a Year is How Much an Hour After Taxes?

When calculating your hourly wage, it’s important to consider the impact of taxes on your income. After all, taxes can significantly reduce your take-home pay.

Assuming that you pay around 25% of your income towards taxes, anyone making $50,000 a year will have an after-tax income of $37,500. This means that the hourly wage for someone making $50,000 a year after taxes is $18.03 per hour.

To break it down further, here’s a table that shows the hourly wage for someone making $50,000 a year before and after taxes:

| Yearly Income | Hourly Wage (Before Taxes) | Hourly Wage (After Taxes) |

|---|---|---|

| $50,000 | $24.04 | $18.03 |

It’s important to note that the actual amount of taxes you pay may vary depending on a number of factors, such as your filing status, deductions, and credits. Additionally, state and local taxes can also impact your take-home pay.

Overall, it’s crucial to consider the impact of taxes when calculating your hourly wage. While $50,000 a year may seem like a good salary, it’s important to understand how taxes can impact your income and adjust your expectations accordingly.

Is $50k a Year Good?

Whether $50,000 a year is a good salary or not largely depends on your individual circumstances and expectations. For some people, it may be a comfortable income, while for others, it may be barely enough to make ends meet.

Here are some factors to consider when determining whether $50k a year is good for you:

Cost of Living

The cost of living varies widely depending on where you live. If you live in a city with a high cost of living, $50k a year may not be enough to cover your basic expenses. On the other hand, if you live in a more affordable area, $50k a year may provide you with a comfortable lifestyle.

Lifestyle

Your lifestyle plays a significant role in determining whether $50k a year is good for you. If you have expensive tastes and enjoy luxury goods and experiences, $50k a year may not be enough to support your lifestyle. However, if you are content with a simpler lifestyle, $50k a year may be more than enough.

Debt and Savings

If you have significant debt or are trying to save for the future, $50k a year may not be enough to meet your financial goals. However, if you have little debt and are able to save a portion of your income, $50k a year may be sufficient.

Career Goals

Finally, your career goals should also be considered when determining whether $50k a year is good for you. If you are content with your current job and have no desire for advancement, $50k a year may be a good salary for you. However, if you have ambitious career goals, $50k a year may not provide you with the income you need to achieve them.

Overall, whether $50k a year is a good salary or not depends on your individual circumstances and expectations. It is important to consider factors such as cost of living, lifestyle, debt and savings, and career goals when making this determination.

Budget Plan for $50k a Year Salary

Managing your finances can be challenging, especially when you are on a tight budget. However, with a little bit of planning and discipline, you can make the most out of your $50,000 a year salary. Here are some tips to help you create a budget plan that works for you:

Determine Your Monthly Income

The first step in creating a budget plan is to determine your monthly income. If you make $50,000 a year, your monthly income before taxes is approximately $4,166. Keep in mind that your take-home pay will be less than this amount due to taxes and other deductions.

Track Your Expenses

Once you know your monthly income, the next step is to track your expenses. This will help you identify where your money is going and where you can cut back. Start by listing all your fixed expenses, such as rent/mortgage, car payment, insurance, utilities, and other bills. Then, list your variable expenses, such as groceries, entertainment, and dining out.

Create a Budget

Based on your income and expenses, create a budget that works for you. Allocate your money to different categories, such as housing, transportation, food, entertainment, and savings. Make sure to prioritize your expenses and focus on your needs rather than wants.

Reduce Your Expenses

If you find that your expenses exceed your income, it’s time to reduce your expenses. Look for ways to cut back on your fixed expenses, such as refinancing your mortgage or negotiating your car insurance rates. For variable expenses, consider shopping at discount stores, cooking at home instead of eating out, and finding free or low-cost entertainment options.

Save for Emergencies

Finally, make sure to set aside some money for emergencies. Aim to save at least 10% of your income for unexpected expenses, such as car repairs or medical bills. Consider opening a separate savings account to keep your emergency fund separate from your other savings.

By following these budgeting tips, you can make the most out of your $50,000 a year salary and achieve your financial goals.

How Can You Increase Your Income if $50k a Year is Not Enough?

If you find that your current income of $50,000 a year is not enough to meet your financial goals, there are several steps you can take to increase your earnings. Here are some ideas to consider:

- Get a higher paying job: One of the most straightforward ways to increase your income is to find a job that pays more. Consider looking for opportunities in your field that offer better pay or consider switching careers to a higher-paying industry.

- Take on a side hustle: Another way to increase your income is to take on a side hustle or part-time job. Consider your skills and interests and look for opportunities to monetize them. For example, you could start a freelance writing or graphic design business or drive for a ride-sharing service.

- Ask for a raise: If you are happy with your current job, but feel that you are not being paid enough, consider asking for a raise. Make sure to prepare a strong case for why you deserve a raise and be willing to negotiate.

- Invest in your education: Investing in your education can lead to higher-paying job opportunities. Consider going back to school to earn a degree or certification in a field that offers higher salaries.

- Start a business: Starting your own business can be a risky venture, but it can also lead to significant financial rewards. Consider starting a business in a field that you are passionate about and that has the potential to generate significant revenue.

By taking these steps, you can increase your income and work towards achieving your financial goals.

Conclusion

Calculating your hourly wage from your annual salary is a simple process that can be done in just a few steps. By dividing your annual salary by the number of hours you work per year, you can determine your hourly rate.

For example, if you make $50,000 a year and work 40 hours per week for 52 weeks, your hourly rate would be $24.04 per hour. It’s important to note that this calculation is based on a standard 40-hour workweek. If you work more or fewer hours, you’ll need to adjust the calculation accordingly.

Knowing your hourly wage can be helpful when negotiating a salary, budgeting for expenses, or comparing job offers. It’s also important to consider factors such as benefits, vacation time, and potential for growth and advancement when evaluating job opportunities.

In addition, it’s worth noting that simply earning a certain hourly wage does not necessarily equate to financial stability or job satisfaction. It’s important to find a job that aligns with your values and goals, and to continually evaluate and reassess your career path.

Overall, calculating your hourly wage is a useful tool for understanding your income and making informed decisions about your career.

Frequently Asked Questions

What is the monthly income of someone earning $50,000 a year after taxes?

Assuming a tax rate of around 22%, the monthly income of someone earning $50,000 a year after taxes would be approximately $3,400. This is calculated by dividing the annual salary by 12 to get the monthly salary and then subtracting the estimated taxes.

How much is the biweekly pay for someone earning $50,000 a year?

The biweekly pay for someone earning $50,000 a year would be around $1,923 before taxes. This is calculated by dividing the annual salary by the number of weeks in a year and then dividing that number by 2 to get the biweekly pay.