If you’re wondering how much $60,000 a year is per hour, you’re not alone. It’s a common question that many people ask themselves when determining their salary expectations or negotiating a job offer. The answer varies depending on the number of hours you work per week and the number of weeks you work per year. However, assuming a standard 40-hour workweek and a 52-week work year, $60,000 a year is equivalent to $28.85 per hour.

It’s important to note that the actual hourly rate may differ depending on your specific circumstances. For example, if you work more than 40 hours per week or take unpaid time off, your hourly rate will be higher. On the other hand, if you work part-time or take paid time off, your hourly rate will be lower. Additionally, the cost of living in your area may affect how far $60,000 a year goes. Nonetheless, knowing the approximate hourly rate can be a useful starting point for budgeting and financial planning.

Convert $60,000 Per Year to Hourly, Daily, Weekly, and Monthly Salary

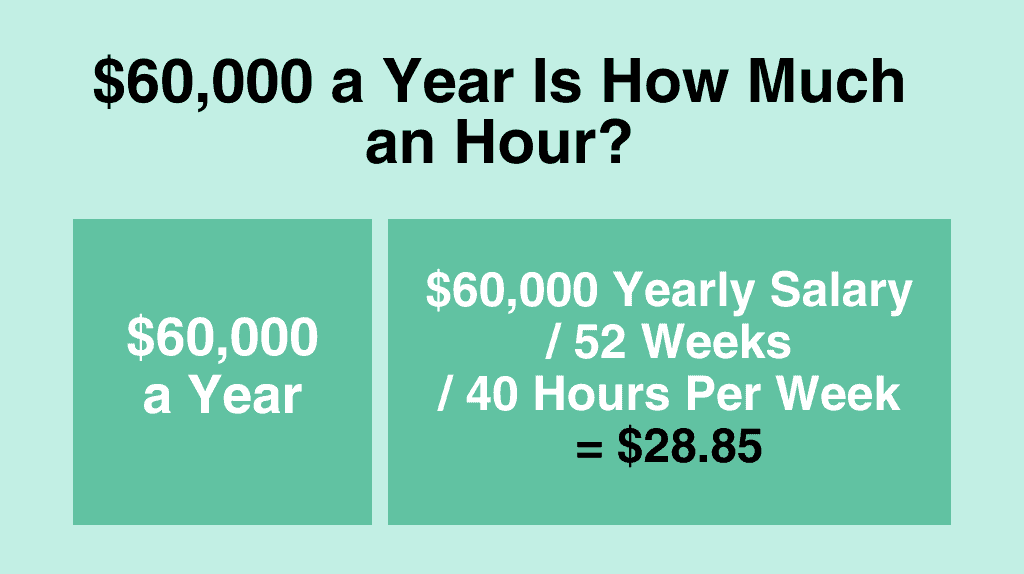

$60,000 Per Year is How Much an Hour?

If you make $60,000 an hour, your hourly salary would be $28.85. We calculate your hourly salary based on 8 hours per day, 5 days per week and 52 weeks in the year.

Annual Salary ($60,000) / Weeks Worked per Year (52) / Hours Worked per Week (40) = $28.85

$60,000 Per Year is How Much a Month?

If you make $60,000 an hour, your monthly salary would be $5,000. We calculate your monthly salary by dividing your annual salary by 12 months.

Annual Salary ($60,000) / Months per Year (12) = $5,000

$60,000 Per Year is How Much Biweekly?

If you make $60,000 an hour, your biweekly salary would be $2,308. We calculate your biweekly salary based on 52 weeks per year.

Annual Salary ($60,000) / Weeks Worked per Year (52) x Number of Weeks (2) = $2,308

$60,000 Per Year is How Much Weekly?

If you make $60,000 an hour, your weekly salary would be $1,154. We calculate your weekly salary based on 52 weeks per year.

Annual Salary ($60,000) / Weeks Worked per Year (52) = $1,154

$60,000 Per Year is How Much Daily?

If you make $60,000 an hour, your daily salary would be $231. We calculate your daily salary based on 5 days per week and 52 weeks in the year.

Annual Salary ($60,000) / Weeks Worked per Year (52) / Days per Week (5) = $231

$60,000 a Year is How Much an Hour After Taxes?

When considering how much $60,000 a year is per hour after taxes, it’s important to keep in mind that the amount will vary depending on your tax bracket and deductions.

Assuming a standard deduction and no other tax credits or deductions, the federal taxes on $60,000 a year would be approximately $8,679. This brings the after-tax income to around $51,321.

Dividing this amount by the total number of hours worked in a year (2,080) results in an hourly wage of approximately $24.64.

It’s important to note that state and local taxes may also impact the after-tax income and hourly wage. Additionally, if you have other deductions or tax credits, your after-tax income and hourly wage may differ.

Is $60k a Year Good?

When it comes to determining whether $60,000 a year is a good salary, it really depends on your personal financial situation and where you live. However, here are some factors to consider:

Cost of Living

The cost of living can vary widely depending on where you live. If you live in an expensive city, $60,000 a year may not go as far as it would in a more affordable area. It’s important to research the cost of living in your area and factor that into your decision.

Federal Minimum Wage

At $60,000 a year, you would be making four times the federal minimum wage of $7.25 per hour. So, in that sense, $60,000 a year is definitely a good salary.

Personal Financial Goals

Another factor to consider is your personal financial goals. If you have a lot of debt or expenses, $60,000 a year may not be enough to meet your needs. On the other hand, if you live a more frugal lifestyle and have fewer expenses, $60,000 a year may be more than enough to meet your needs.

Career Advancement

It’s also important to consider your potential for career advancement. If you’re in a job with little room for growth, $60,000 a year may be the most you’ll ever make. However, if you’re in a field with opportunities for advancement, you may be able to increase your salary significantly over time.

Whether $60,000 a year is a good salary really depends on your personal financial situation and goals. However, compared to the federal minimum wage and depending on where you live, $60,000 a year can be considered a good salary.

Budget Plan for $60k a Year Salary

Managing your finances can be a daunting task, but with a solid budget plan, you can make your $60,000 a year salary work for you. Here are some tips to help you budget your money effectively:

Determine Your Monthly Income

To start your budget plan, you need to determine your monthly income. Since you earn $60,000 a year, your monthly income would be around $5,000. This amount can vary depending on your tax deductions, so it’s important to calculate your net income accurately.

Calculate Your Monthly Expenses

After determining your monthly income, it’s time to calculate your monthly expenses. Your expenses may include rent or mortgage payments, utilities, groceries, transportation, insurance, and other bills. It’s important to keep track of your expenses and categorize them to get a clear picture of where your money is going.

Allocate Your Income

Once you have calculated your monthly income and expenses, you can allocate your income accordingly. You can divide your income into different categories such as savings, bills, and discretionary spending. It’s important to prioritize your expenses and allocate your income accordingly.

Create a Savings Plan

It’s always a good idea to have a savings plan in place. You can set aside a portion of your income each month for emergency funds, retirement, and other investments. A good rule of thumb is to save at least 20% of your income each month.

Track Your Spending

Tracking your spending is crucial to sticking to your budget plan. You can use budgeting apps or spreadsheets to keep track of your expenses and monitor your spending. This will help you identify areas where you can cut back and save money.

By following these budgeting tips, you can make the most of your $60,000 a year salary and achieve your financial goals.

How Can You Increase Your Income if $60k a Year is Not Enough?

If you’re earning $60,000 a year and find that it’s not enough to cover your expenses or meet your financial goals, there are several things you can do to increase your income. Here are some strategies to consider:

1. Negotiate a raise or promotion

Asking for a raise or promotion is a common way to increase your income. However, it’s important to prepare for this conversation and make a strong case for why you deserve a higher salary. Highlight your accomplishments, skills, and contributions to the company. Research the market rate for your position and use this information to support your request.

2. Look for a higher-paying job

If your current employer is not able to offer you a higher salary, you may want to consider looking for a higher-paying job elsewhere. Research job openings in your field and consider networking with professionals in your industry. Update your resume and cover letter to highlight your skills and experience.

3. Develop new skills

Investing in your education and skills can help you qualify for higher-paying jobs or promotions. Consider taking courses or certification programs in your field, or learn new skills that are in demand. Look for opportunities to gain hands-on experience or volunteer in your community.

4. Start a side hustle

Starting a side hustle can be a great way to earn extra income outside of your regular job. Think about your skills and interests and look for ways to monetize them. You could start a freelance business, sell products online, or offer consulting services.

5. Invest in stocks or real estate

Investing in stocks or real estate can be a way to generate passive income and increase your wealth over time. However, it’s important to do your research and understand the risks involved. Consider working with a financial advisor or real estate agent to help you make informed decisions.

By implementing these strategies, you can increase your income and improve your financial situation. Remember to be patient and persistent in your efforts, and don’t be afraid to seek help or advice when needed.

Conclusion

Now that you know how much $60,000 a year is in terms of hourly wage, you can better understand your earning potential and make informed decisions about your career.

Keep in mind that this calculation is based on a full-time job with 40 hours per week and 52 weeks per year. If you work part-time or take paid vacation, your hourly wage will be higher.

It’s important to consider other factors when evaluating a salary, such as the cost of living in your area and the benefits offered by your employer.

If you are earning $60,000 a year, you are making a decent income, but it may not be enough to support a family or afford a comfortable lifestyle in some areas. It’s always a good idea to continue to develop your skills and seek out opportunities for advancement in your career.

Overall, knowing your hourly wage can help you make informed decisions about your finances and plan for a successful future.

Frequently Asked Questions

Is $60,000 a year a good salary?

Whether $60,000 a year is a good salary or not depends on various factors such as your location, lifestyle, and expenses. In some areas, this salary may be considered above average, whereas in other areas, it may be average or even below average. Ultimately, it depends on your personal financial goals and needs.

Can you live comfortably on $60,000 a year?

Living comfortably on $60,000 a year is possible, but it depends on your lifestyle and expenses. If you live in an area with a low cost of living and don’t have significant debt, you may be able to live comfortably on this salary. However, if you have high expenses or live in an expensive area, you may find it challenging to make ends meet on $60,000 a year.