If you’re wondering how much you make per hour with a yearly salary of $65,000, you’re not alone. Many people want to know the hourly rate equivalent of their annual income, whether it’s for budgeting, negotiating a raise, or comparing job offers. Fortunately, it’s easy to calculate the hourly wage for a $65,000 salary.

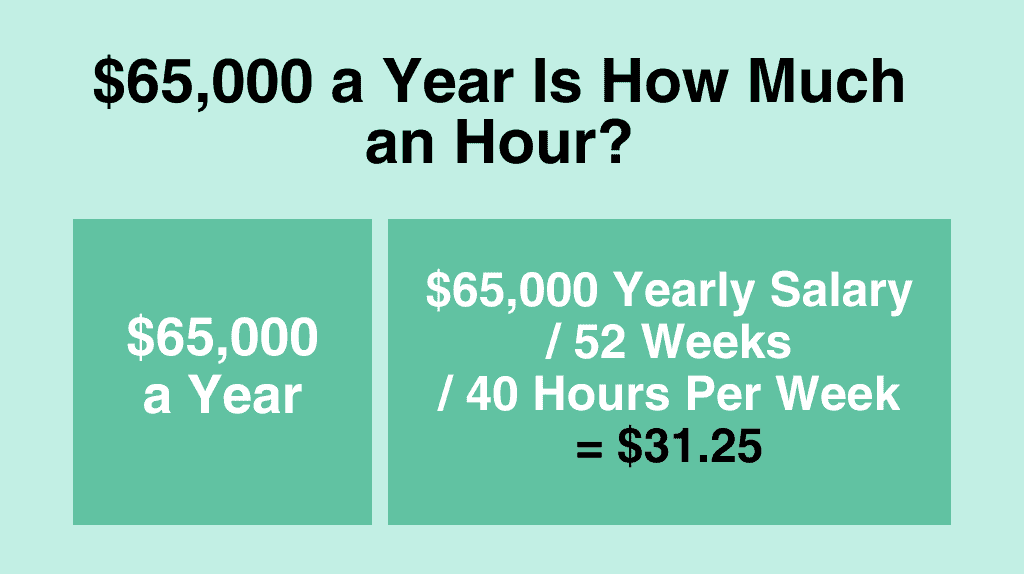

Assuming a 40-hour workweek and 52 workweeks per year, a $65,000 salary translates to an hourly rate of about $31.25. However, keep in mind that this is a rough estimate, as it doesn’t take into account factors such as overtime, bonuses, or benefits. Additionally, your actual hourly rate may vary depending on your job title, industry, location, and experience level.

Convert $65,000 Per Year to Hourly, Daily, Weekly, and Monthly Salary

$65,000 Per Year is How Much an Hour?

If you make $65,000 an hour, your hourly salary would be $31.25. We calculate your hourly salary based on 8 hours per day, 5 days per week and 52 weeks in the year.

Annual Salary ($65,000) / Weeks Worked per Year (52) / Hours Worked per Week (40) = $31.25

$65,000 Per Year is How Much a Month?

If you make $65,000 an hour, your monthly salary would be $5,417. We calculate your monthly salary by dividing your annual salary by 12 months.

Annual Salary ($65,000) / Months per Year (12) = $5,417

$65,000 Per Year is How Much Biweekly?

If you make $65,000 an hour, your biweekly salary would be $2,500. We calculate your biweekly salary based on 52 weeks per year.

Annual Salary ($65,000) / Weeks Worked per Year (52) x Number of Weeks (2) = $2,500

$65,000 Per Year is How Much Weekly?

If you make $65,000 an hour, your weekly salary would be $1,250. We calculate your weekly salary based on 52 weeks per year.

Annual Salary ($65,000) / Weeks Worked per Year (52) = $1,250

$65,000 Per Year is How Much Daily?

If you make $65,000 an hour, your daily salary would be $250. We calculate your daily salary based on 5 days per week and 52 weeks in the year.

Annual Salary ($65,000) / Weeks Worked per Year (52) / Days per Week (5) = $250

$65,000 a Year is How Much an Hour After Taxes?

If you make $65,000 a year, your hourly wage after taxes will be lower than your pre-tax hourly wage. The amount you pay in taxes depends on many different factors, including your filing status, deductions, and credits. However, assuming a 25% to 30% tax rate is reasonable.

To calculate your hourly wage after taxes, you need to know your pre-tax hourly wage and your tax rate. If we assume a 25% tax rate, your after-tax hourly wage would be $23.44. This means that for every hour you work, you will take home $23.44 after taxes.

It’s important to note that this calculation is just an estimate and your actual tax rate may be higher or lower depending on your specific circumstances. You may also be eligible for deductions and credits that can lower your tax bill.

Overall, it’s important to consider both your pre-tax and after-tax hourly wage when evaluating your salary. While $65,000 a year may seem like a good salary, it’s important to factor in taxes and other expenses to get a more accurate picture of your take-home pay.

Is $65k a Year Good?

If you are earning $65,000 a year, you may be wondering whether it is a good salary or not. The answer to this question depends on various factors, such as your location, lifestyle, and expenses. Here are some points to consider:

Average Salary

According to the United States Bureau of Labor Statistics, the median salary for all workers in the United States was $49,700 per year in 2020. So, earning $65,000 a year is above average and puts you in a good position compared to most people.

Cost of Living

However, the cost of living varies widely across different regions of the United States. For example, living in New York City or San Francisco is more expensive than living in a small town in the Midwest. So, while $65,000 a year may be a good salary in some areas, it may not be enough to cover your expenses in other regions.

Lifestyle

Your lifestyle also plays a significant role in determining whether $65,000 a year is a good salary for you. If you are single and have no dependents, you may be able to live comfortably on this salary. However, if you have a family to support or expensive hobbies, you may find it challenging to make ends meet on $65,000 a year.

Savings

Another factor to consider is your savings. If you are living paycheck to paycheck and have no savings, $65,000 a year may not be enough to achieve your financial goals. However, if you are able to save a significant portion of your income, you can build a solid financial foundation and plan for the future.

Whether $65,000 a year is a good salary or not depends on various factors. While it is above average compared to the median salary in the United States, it may not be enough to cover your expenses in some regions or support an expensive lifestyle.

Budget Plan for $65k a Year Salary

If you earn a salary of $65,000 a year, it is important to have a budget plan in place to ensure that you are living within your means and saving for your future. Here are some tips to help you create a budget plan that works for you:

1. Determine Your Monthly Income

The first step in creating a budget plan is to determine your monthly income. If you earn $65,000 a year, your monthly income would be approximately $5,416.67. This amount can be used as a starting point for your budget plan.

2. Calculate Your Monthly Expenses

The next step is to calculate your monthly expenses. This includes your rent or mortgage payment, utilities, food, transportation, and any other bills or expenses you have. It is important to be as accurate as possible when calculating your expenses to ensure that you have a realistic budget plan.

3. Create a Budget Plan

Once you have determined your monthly income and expenses, you can create a budget plan. This involves allocating your income towards your expenses and savings goals. It is important to prioritize your expenses and ensure that you are saving for your future.

Here is an example of a budget plan for someone earning $65,000 a year:

| Category | Monthly Amount |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities | $150 |

| Food | $400 |

| Transportation | $200 |

| Entertainment | $150 |

| Savings | $1,000 |

| Other Expenses | $500 |

| Total Expenses | $3,600 |

In this example, the individual is allocating $1,000 towards savings each month, which is approximately 18% of their monthly income. This is a good goal to aim for, as financial experts recommend saving at least 15% of your income each month.

4. Adjust Your Budget Plan as Needed

It is important to regularly review and adjust your budget plan as needed. If your expenses or income changes, you may need to adjust your budget plan to ensure that you are still living within your means and saving for your future.

By creating a budget plan and sticking to it, you can ensure that you are making the most of your $65,000 a year salary and setting yourself up for financial success.

How Can You Increase Your Income if $65k a Year is Not Enough?

If you’re earning $65k a year and feel like it’s not enough to meet your financial goals, there are several ways to increase your income. Here are some options to consider:

1. Ask for a Raise or Promotion

If you’ve been in your current job for a while and have been performing well, it may be time to ask for a raise or promotion. Make a list of your accomplishments and contributions to the company and present it to your boss during a performance review or one-on-one meeting. Be confident and clear about your value to the company and why you deserve a raise or promotion.

2. Start a Side Hustle

Starting a side hustle can be a great way to increase your income. Consider your skills and interests and look for opportunities to monetize them. You could start a blog, sell products online, or offer freelance services. Just be sure to keep track of your income and expenses for tax purposes.

3. Invest in Education or Training

Investing in education or training can help you qualify for higher-paying jobs or advance in your current career. Look for courses or certifications that are in demand in your industry and invest in yourself. You could also consider going back to school for a degree if it makes sense for your career goals.

4. Explore Other Job Opportunities

If you’ve hit a ceiling in your current job, it may be time to explore other job opportunities. Look for jobs in your field that pay more or offer better benefits. You could also consider switching careers if you’re not satisfied with your current field.

By taking these steps, you can increase your income and work towards your financial goals. Remember to be patient and persistent, and don’t be afraid to take risks and try new things.

Conclusion

In conclusion, if you are earning $65,000 a year, your hourly rate would be approximately $31.25 based on a 40-hour workweek. However, it is important to keep in mind that this is just an estimate and your actual hourly rate may vary based on the number of hours you work and any benefits you may receive.

When it comes to taxes, the amount you pay will depend on your individual circumstances and the state you live in. Different states have different tax rates, ranging from 0 state taxes in Texas to a graduated rate in California. It is important to consult with a tax professional to determine your exact tax liability.

If you are looking to save money, there are several ways to do so. For example, you could consider living in a more affordable area, cutting back on unnecessary expenses, and taking advantage of any employer-sponsored retirement plans.

Overall, earning $65,000 a year can provide a comfortable living for many individuals and families. By carefully managing your finances and making smart financial decisions, you can make the most of your income and achieve your financial goals.

Frequently Asked Questions

How much is $65,000 a year per month after taxes?

The amount of money you take home each month after taxes depends on a variety of factors, such as your tax bracket, deductions, and credits. However, if we assume a standard tax rate of 25%, your monthly take-home pay would be approximately $3,906.25.

What is the biweekly salary for $65,000 a year?

If you get paid biweekly, your gross paycheck would be approximately $2,500. However, your take-home pay would depend on various factors such as taxes, deductions, and benefits.

Is $65,000 a year a good salary?

Whether or not $65,000 a year is a good salary depends on your individual circumstances and where you live. In some areas, this salary may be considered above average, while in others it may be below average. It’s important to consider factors such as cost of living, job market, and personal financial goals when evaluating the adequacy of a salary.