If you’re wondering how much an annual salary of $70,000 equates to on an hourly basis, you’re not alone. Many people prefer to think about their income in terms of hourly wages, especially when comparing job opportunities or negotiating pay raises. The good news is that the calculation is relatively straightforward, and there are many resources available to help you determine your hourly rate.

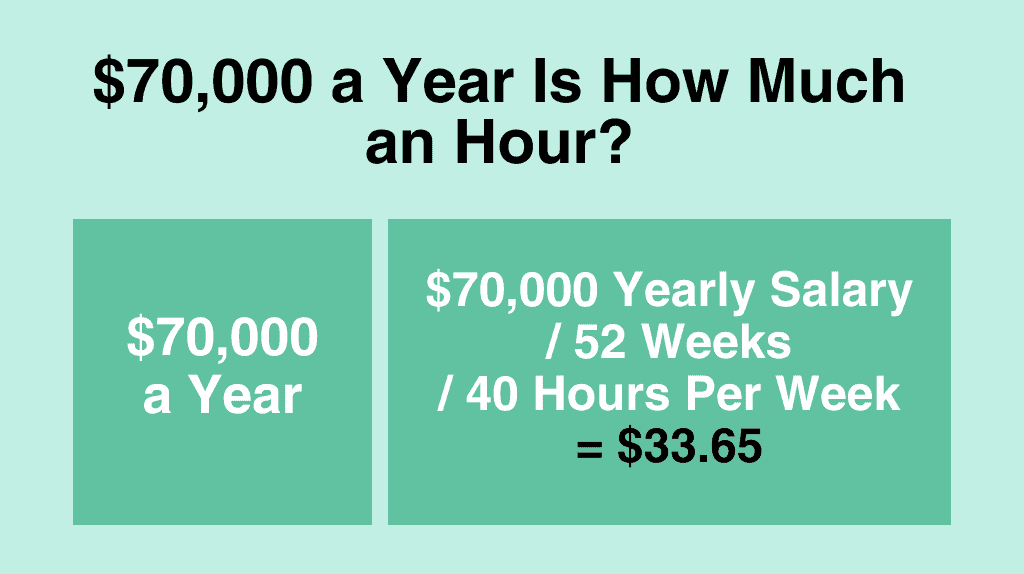

Assuming a standard 40-hour workweek and 52 weeks of work per year, an annual salary of $70,000 breaks down to $33.65 per hour. Of course, this calculation may vary depending on factors such as your specific job duties, the number of hours you work each week, and any overtime or bonuses you receive. However, it provides a useful starting point for understanding the value of your salary in terms of hourly wages.

Convert $70,000 Per Year to Hourly, Daily, Weekly, and Monthly Salary

$70,000 Per Year is How Much an Hour?

If you make $70,000 an hour, your hourly salary would be $33.65. We calculate your hourly salary based on 8 hours per day, 5 days per week and 52 weeks in the year.

Annual Salary ($70,000) / Weeks Worked per Year (52) / Hours Worked per Week (40) = $33.65

$70,000 Per Year is How Much a Month?

If you make $70,000 an hour, your monthly salary would be $5,833. We calculate your monthly salary by dividing your annual salary by 12 months.

Annual Salary ($70,000) / Months per Year (12) = $5,833

$70,000 Per Year is How Much Biweekly?

If you make $70,000 an hour, your biweekly salary would be $2,692. We calculate your biweekly salary based on 52 weeks per year.

Annual Salary ($70,000) / Weeks Worked per Year (52) x Number of Weeks (2) = $2,692

$70,000 Per Year is How Much Weekly?

If you make $70,000 an hour, your weekly salary would be $1,346. We calculate your weekly salary based on 52 weeks per year.

Annual Salary ($70,000) / Weeks Worked per Year (52) = $1,346

$70,000 Per Year is How Much Daily?

If you make $70,000 an hour, your daily salary would be $269. We calculate your daily salary based on 5 days per week and 52 weeks in the year.

Annual Salary ($70,000) / Weeks Worked per Year (52) / Days per Week (5) = $269

$70,000 a Year is How Much an Hour After Taxes?

When calculating your hourly wage based on an annual salary of $70,000, it’s important to consider the impact of taxes on your take-home pay. The amount of taxes you pay can vary depending on your filing status, state and local tax rates, and other factors.

If you’re a single filer earning $70,000 a year, you would pay 10% on the first $11,000, 12% on the next $33,725, and 22% on the rest, which is $25,275. This means your total tax liability would be $10,452.50, leaving you with an after-tax income of $59,547.50.

Using this after-tax income, your hourly wage would be approximately $28.57 per hour, assuming you work 40 hours per week for 52 weeks per year. However, it’s important to note that this calculation is based on federal tax rates only and does not take into account state and local taxes, which can further reduce your take-home pay.

To get a more accurate estimate of your hourly wage after taxes, you can use a salary to hourly calculator that takes into account your specific tax situation. These calculators can help you determine your after-tax income and hourly wage based on your annual salary, tax bracket, and other factors.

It’s important to consider the impact of taxes on your hourly wage when calculating your income. By taking into account federal, state, and local taxes, you can get a more accurate estimate of your take-home pay and make more informed decisions about your finances.

Is $70k a Year Good?

Whether $70,000 a year is a good salary or not depends on various factors, including your location, financial situation, and lifestyle. However, according to Market Realist, if you’re earning $70,000 a year, you’re making more than 73% of workers in the United States, which is above average.

It’s important to consider your expenses and financial goals when determining if $70,000 a year is good for you. If you live in an expensive city and have high expenses, $70,000 a year may not be enough to cover your costs. On the other hand, if you live in a more affordable area and have a low cost of living, $70,000 a year could provide a comfortable lifestyle.

It’s also important to consider your financial goals. If you’re saving for retirement or have other financial obligations, $70,000 a year may not be enough for you. However, if you’re able to live within your means and save money, $70,000 a year could be a good salary for you.

Whether $70,000 a year is good for you depends on your individual circumstances. It’s important to consider your expenses, financial goals, and location when determining if $70,000 a year is a good salary for you.

Budget Plan for $70k a Year Salary

If you make $70,000 a year, it’s important to create a budget plan to ensure you’re making the most of your income. Here are some tips to help you manage your finances:

1. Determine Your Monthly Income

Before creating a budget plan, you need to know how much money you’re bringing in each month. If you’re paid bi-weekly, you’ll receive 26 paychecks a year. Divide your annual salary by 26 to get your bi-weekly pay. Then, multiply that number by two to get your monthly income.

2. Calculate Your Monthly Expenses

The next step is to calculate your monthly expenses. This includes rent/mortgage, utilities, groceries, transportation, insurance, and any other bills you have. Use your past bills to help you determine the average cost for each expense.

3. Allocate Your Income

Once you know your monthly income and expenses, you can allocate your income accordingly. It’s recommended to follow the 50/30/20 rule. This means allocating 50% of your income to necessities (rent/mortgage, utilities, groceries, transportation, insurance), 30% to discretionary spending (entertainment, dining out, shopping), and 20% to savings (emergency fund, retirement, investments).

4. Track Your Spending

To ensure you’re sticking to your budget plan, it’s important to track your spending. Use a budgeting app or spreadsheet to keep track of your expenses and adjust your budget plan accordingly.

By creating a budget plan and following these tips, you can make the most of your $70k a year salary and achieve your financial goals.

How Can You Increase Your Income if $70k a Year is Not Enough?

If you’re making $70k a year and it’s not enough to cover your expenses or achieve your financial goals, there are several ways to increase your income. Here are some options to consider:

1. Ask for a Raise or Promotion

One way to increase your income is to ask for a raise or promotion at your current job. If you’ve been with your employer for a while and have a good track record, it may be time to negotiate a higher salary.

2. Look for a Higher-Paying Job

If you’re not able to get a raise or promotion at your current job, consider looking for a higher-paying job elsewhere. Look for job openings in your field and research the salary ranges for those positions.

3. Start a Side Hustle

Starting a side hustle can be a great way to increase your income. Consider your skills and interests and look for opportunities to monetize them. Some examples of side hustles include freelance writing, tutoring, pet-sitting, and selling items online.

4. Invest in Stocks or Real Estate

Investing in stocks or real estate can be a long-term strategy for increasing your income. While there are risks involved, if done correctly, investing can provide passive income streams that can supplement your salary.

5. Cut Expenses

Finally, if you’re not able to increase your income, consider cutting expenses to free up more money. Look for ways to reduce your monthly bills, such as negotiating with service providers or downsizing your living arrangements.

Remember, increasing your income takes time and effort. Consider your options carefully and make a plan for achieving your financial goals.

Conclusion

In summary, earning $70,000 a year equates to an hourly wage of $33.65, assuming a standard 40-hour work week across 52 weeks of the year. However, this hourly wage can vary based on factors such as the number of hours worked per week and the pay period.

It’s important to note that $70,000 a year is a good salary, above the national average, and can provide a comfortable standard of living for many individuals. However, it’s also essential to consider factors such as cost of living, location, and job market demand when evaluating the value of a salary.

If you’re looking to compare your current pay to a new potential job, use the gross pay breakdown to see how your salary would translate to hourly wages. Additionally, using tools such as a salary to hourly calculator can provide a more accurate estimate of your hourly wage.

Overall, while $70,000 a year may not be a one-size-fits-all salary, it’s a solid income that can provide financial stability and opportunities for many individuals.

Frequently Asked Questions

How much is 70k biweekly?

If you make $70,000 a year, your biweekly pay would be around $2,692.31 before taxes. However, keep in mind that this amount may vary depending on your employer’s payroll schedule and any deductions or benefits you may receive.

How much is $70,000 a year per month?

If you make $70,000 a year, your monthly pay would be around $5,833.33 before taxes. Again, this amount may vary depending on your employer’s payroll schedule and any deductions or benefits you may receive.

Is $70,000 a good salary?

Whether or not $70,000 a year is a good salary depends on various factors, such as your location, industry, and personal financial goals. However, according to the Bureau of Labor Statistics, the median annual wage for all occupations in the United States is around $41,950 as of May 2020. So, earning $70,000 a year would put you above the median wage.