If you are currently making $10 an hour, you may wonder how much your yearly salary is. The answer is not as straightforward as it may seem. Many factors come into play, such as the number of hours you work per week and the amount of taxes you pay. However, with some simple calculations, you can estimate your annual income.

Assuming you work 40 hours per week, 50 weeks per year, your yearly salary would be $20,000 before taxes. However, after taxes, your take-home pay would be around $15,600 per year, assuming a tax rate of 25%. Keep in mind that tax rates can vary depending on your location, income bracket, and other factors, so your actual take-home pay may differ.

Convert $10 Per Hour to Weekly, Monthly, and Yearly Salary

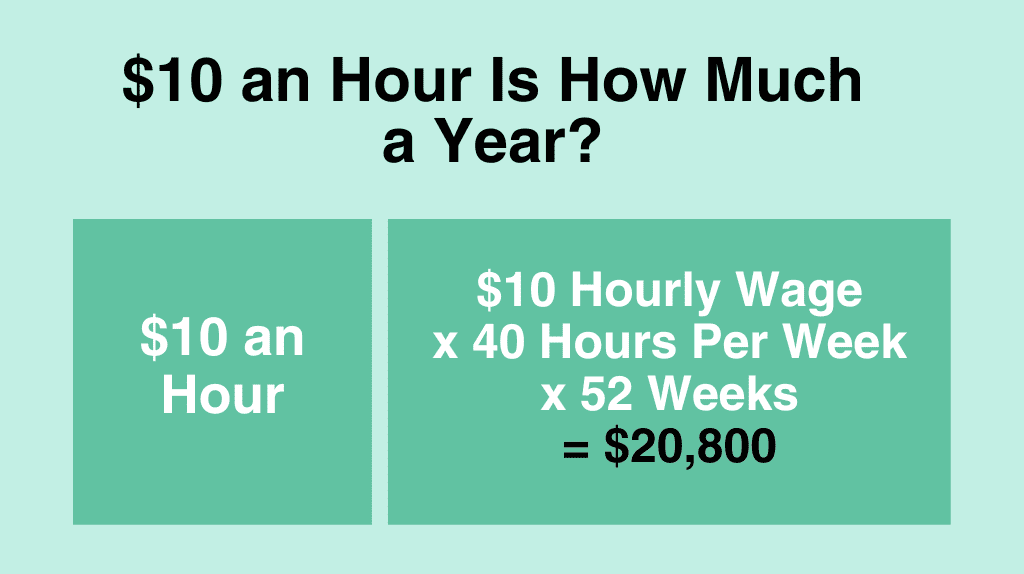

$10 an Hour is How Much a Year?

If you make $10 an hour, your annual salary would be $20,800. We calculate your annual salary based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hourly Wage ($10) x Hours Worked per Week (40) x Weeks Worked per Year (52) = $20,800

$10 an Hour is How Much a Month?

If you make $10 an hour, your monthly salary would be $1,733. We calculate your monthly salary by dividing your annual salary by 12 months.

Hourly Wage ($10) x Hours Worked per Week (40) x Weeks Worked per Year (52) / Months per Year (12) = $1,733

$10 an Hour is How Much Biweekly?

If you make $10 an hour, your biweekly salary would be $800. We calculate your biweekly salary based on 8 hours per day, 5 days per week.

Hourly Wage ($10) x Hours Worked per Week (40) x Number of Weeks (2) = $800

$10 an Hour is How Much Weekly?

If you make $10 an hour, your biweekly salary would be $400. We calculate your weekly salary based on 8 hours per day, 5 days per week.

Hourly Wage ($10) x Hours Worked per Week (40) = $400

$10 an Hour is How Much Daily?

If you make $10 an hour, your biweekly salary would be $80. We calculate your daily salary based on 8 hours per day.

Hourly Wage ($10) x Hours Worked per Day (8) = $80

$10 an Hour is How Much a Year After Taxes?

Federal Income Tax

When calculating your yearly income after taxes, one of the most important factors to consider is federal income tax. This tax is based on your total income for the year, and the amount you owe will depend on your tax bracket. Here’s a breakdown of the federal income tax brackets for 2023:

| Tax Rate | Single Filers |

|---|---|

| 10% | $0 to $11,600 |

| 12% | $11,001 to $44,725 |

| 22% | $44,726 to $95,375 |

| 24% | $95,376 to $182,100 |

| 32% | $182,101 to $231,250 |

| 35% | $231,251 to $578,125 |

| 37% | $578,126 or more |

To calculate your federal income tax, you’ll need to determine which tax bracket you fall into based on your total income. Then, you can use the corresponding tax rate to calculate your tax liability.

For example, if you are single and you earn $20,800 per year at a rate of $10 per hour, this means you would owe $2,276 in federal income tax for the year.

Estimated federal income tax (single filers) = $2,276

State Income Tax

While nine states do not impose their own income tax for tax year 2024, the majority of states do.

State income tax rates vary widely across the United States, ranging from 0% to over 13%. To help you estimate your take-home pay after state income tax, we’ve compiled a chart of state income tax rates for all 50 states.

| State | State Income Tax Rate |

|---|---|

| Alabama | 2% – 5% |

| Alaska | 0% |

| Arizona | 2.59% – 4.50% |

| Arkansas | 0.9% – 6.6% |

| California | 1% – 13.30% |

| Colorado | 4.55% |

| Connecticut | 3% – 6.99% |

| Delaware | 0% |

| Florida | 0% |

| Georgia | 1% – 5.75% |

| Hawaii | 1.40% – 11% |

| Idaho | 1.125% – 6.925% |

| Illinois | 4.95% |

| Indiana | 3.23% |

| Iowa | 0.33% – 8.53% |

| Kansas | 3.10% – 5.70% |

| Kentucky | 2% – 5% |

| Louisiana | 2% – 6% |

| Maine | 5.00% |

| Maryland | 2% – 5.75% |

| Massachusetts | 5.00% |

| Michigan | 4.25% |

| Minnesota | 5.35% – 9.85% |

| Mississippi | 0% – 5% |

| Missouri | 1.5% – 5.4% |

| Montana | 1% – 6.9% |

| Nebraska | 2.46% – 6.84% |

| Nevada | 0% |

| New Hampshire | 5% |

| New Jersey | 1.4% – 10.75% |

| New Mexico | 1.7% – 4.90% |

| New York | 4% – 8.82% |

| North Carolina | 5.25% |

| North Dakota | 1.10% – 2.90% |

| Ohio | 0% – 4.797% |

| Oklahoma | 0.5% – 5% |

| Oregon | 4.75% – 9.90% |

| Pennsylvania | 3.07% |

| Rhode Island | 3.75% – 5.99% |

| South Carolina | 0% – 7% |

| South Dakota | 0% |

| Tennessee | 0% |

| Texas | 0% |

| Utah | 4.95% |

| Vermont | 3.35% – 8.75% |

| Virginia | 2% – 5.75% |

| Washington | 0% |

| West Virginia | 3% – 6.5% |

| Wisconsin | 4% – 7.65% |

| Wyoming | 0% |

As you can see, state income tax rates vary significantly. It’s important to check the state income tax rate for your state to get an accurate estimate of your take-home pay.

For example, if you live in Colorado with a flat 4.55% tax rate, your estimated state tax is $946.

Gross Income ($20,800) x State Income Tax (4.55%) = $946

Local Taxes

Local taxes can vary widely depending on where you live and work, so it’s important to research and understand the local tax laws in your area.

Here’s a table that shows the local income tax rates for some of the largest cities in the United States:

| City | Local Income Tax Rate |

|---|---|

| New York City | 3.88% |

| Los Angeles | 1.5% |

| Chicago | 4.95% |

| Houston | 0% |

| Phoenix | 0% |

| Philadelphia | 3.87% |

| San Antonio | 0% |

| San Diego | 0% |

| Dallas | 0% |

| San Jose | 0.94% |

As you can see, local income tax rates can vary widely, with some cities having no local income tax at all. It’s important to factor in these local taxes when calculating your take-home pay, as they can have a significant impact on your overall earnings.

For example, if you live in Los Angeles with 1.5% local tax rate, your estimated state tax is $312.

Gross Income ($20,800) x State Income Tax (1.5%) = $312

FICA Taxes (Social Security & Medicare)

FICA taxes consist of Social Security and Medicare taxes, which are mandatory contributions to support these programs.

The current FICA tax rate is 15.3%, with 6.2% for the employer’s portion of Social Security and 6.2% for the employee’s portion. Additionally, 1.45% is allocated for the employer’s portion of Medicare and 1.45% for the employee’s portion.

To calculate your FICA taxes, you can use a FICA tax calculator. These calculators take into account your income, filing status, and other factors to determine your FICA tax liability. It’s important to note that FICA taxes are only applicable to income up to a certain amount.

For the year 2024, the Social Security wage base is $168,600, meaning that any income earned above this amount is not subject to Social Security taxes.

If you are earning $10 an hour, your estimated FICA taxes is $1,591.

Gross Income ($20,800) x FICA Tax (6.2% + 1.45%) = $1,591

Calculating Your After-Tax Salary

If you are earning $10 an hour, you may be wondering how much your total after-tax salary would be. Calculating your after-tax salary can be a bit tricky, but it’s important to know how much money you will actually take home.

Estimated Federal Tax: $2,276

Estimated State Tax: $946

Estimated Local Tax: $312

Estimated FICA Tax: $1,591

Total Estimated Tax: $5,125

To calculate your take-home pay, you take your gross salary and subtract your total estimated tax. Your actual take-home pay may vary depending on your filing status and your deductions.

Gross Income ($20,800) – Total Estimated Tax ($5,125) = $15,675

Is $10 an Hour Good?

When it comes to determining whether $10 an hour is good pay, it depends on various factors such as your location, job type, and lifestyle. However, in general, $10 an hour is considered a low wage in the United States.

According to the United States Bureau of Labor Statistics, the median hourly wage for all occupations in May 2022 was $20.17. This means that $10 an hour is in the bottom 10% of wages in the country.

It’s important to note that the cost of living varies significantly across the United States. In some areas, $10 an hour may be enough to cover basic expenses, while in others, it may not even be close. Therefore, it’s crucial to consider the cost of living in your area when evaluating whether $10 an hour is good pay.

Additionally, $10 an hour may not provide you with enough income to save for retirement, pay off debt, or achieve other financial goals. It’s essential to consider your long-term financial goals and evaluate whether $10 an hour is enough to support them.

Comparing $10 an Hour with Minimum Wage

If you are earning $10 an hour, you may wonder how it compares to the minimum wage. The federal minimum wage in the United States is currently set at $7.25 per hour. Some states and cities have a higher minimum wage, but $7.25 is the minimum wage floor across the country.

If you are making $10 an hour, you are earning more than the minimum wage. In fact, $10 an hour is about 38% higher than the federal minimum wage. This means that you would earn about $3 more per hour than someone who is making minimum wage.

Earning $10 an hour is higher than the federal minimum wage, but it is still considered a low wage. It may be difficult to live on this wage alone, especially if you have dependents or live in an area with a high cost of living.

Budget Plan for $10 an Hour Salary

If you are earning $10 an hour, you might be wondering how to make ends meet. With a gross annual income of $20,800, it can be challenging to manage expenses and save for the future. However, with proper planning and budgeting, you can make the most of your earnings and achieve financial stability.

Here’s a budget plan to help you manage your expenses on a $10 an hour salary:

1. Determine Your Monthly Income

Assuming you work full-time, your monthly income would be approximately $1,733 before taxes. However, your actual take-home pay may be lower due to deductions for taxes, social security, and other benefits. To get an accurate estimate of your net income, use a paycheck calculator or consult with your employer.

2. Prioritize Your Expenses

Once you know your monthly income, prioritize your expenses based on your needs and wants. Start with essential expenses such as rent, utilities, groceries, and transportation. Then, allocate funds for other expenses such as entertainment, dining out, and shopping.

3. Create a Budget

Use a budgeting tool or spreadsheet to create a budget that reflects your expenses and income. Be realistic and flexible, and adjust your budget as needed to accommodate unexpected expenses or changes in income.

4. Reduce Your Expenses

Look for ways to reduce your expenses and save money. For example, consider cooking at home instead of eating out, using public transportation instead of owning a car, or shopping for deals and discounts. Small changes can add up and help you save more money in the long run.

5. Build an Emergency Fund

Set aside a portion of your income each month for an emergency fund. Aim to have at least three to six months of living expenses saved in case of unexpected events such as job loss, illness, or car repairs.

6. Plan for the Future

Consider investing in your future by saving for retirement, further education, or other long-term goals. Look for low-cost investment options such as a 401(k) or IRA, and start saving as early as possible to take advantage of compound interest.

By following these steps, you can create a budget plan that works for you and helps you achieve your financial goals. With discipline and patience, you can make the most of your $10 an hour salary and build a brighter financial future.

How Can You Increase Your Income if $10 an Hour is Not Enough?

If you feel that your current hourly rate of $10 is not enough to meet your financial goals, there are several ways to increase your income. Here are a few options to consider:

1. Ask for a Raise or Promotion

One of the most straightforward ways to increase your income is to ask your employer for a raise or promotion. Before you make your request, research the average salary for your position and experience level in your area. Be prepared to make a case for why you deserve a higher rate of pay, such as your performance, skills, and accomplishments.

2. Look for a Higher-Paying Job

If your current employer is not willing or able to increase your pay, consider looking for a higher-paying job. Research job listings in your field and consider applying for positions that match your skills and experience. Be sure to tailor your resume and cover letter to each job application and prepare for interviews by practicing your responses to common questions.

3. Develop New Skills

Learning new skills can make you more valuable to employers and increase your earning potential. Consider taking courses or workshops in areas that are in high demand, such as technology, healthcare, or finance. You can also develop your skills by volunteering or taking on new responsibilities at work.

4. Start a Side Hustle

Starting a side hustle can be a great way to earn extra income outside of your regular job. Consider your skills and interests and look for opportunities to monetize them, such as freelancing, selling products online, or offering services like pet-sitting or house cleaning.

5. Invest in Yourself

Investing in yourself can pay off in the long run by increasing your earning potential and career opportunities. Consider pursuing additional education or certifications that can help you advance in your field. You can also invest in your physical and mental health by exercising, eating well, and practicing self-care.

By taking action to increase your income, you can improve your financial situation and work towards your goals. Consider which options are best for you and take the necessary steps to make it happen.

Conclusion

In summary, if you are making $10 an hour, you can expect to earn approximately $20,800 per year before taxes. This assumes that you work 40 hours per week for 50 weeks out of the year. However, it’s important to note that your actual earnings may be slightly lower if you work less than 40 hours per week or if you take time off for holidays or vacation.

When budgeting your income, it’s important to consider your expenses and prioritize your spending. With a yearly income of $20,800, you may need to make some adjustments to your lifestyle in order to make ends meet. Consider creating a budget and tracking your expenses to ensure that you are living within your means.

It’s also worth noting that $10 an hour may not be considered a high wage in many areas, and you may want to consider seeking additional education or training to increase your earning potential. There are many resources available for career development, including vocational schools, community colleges, and online courses.

Overall, while $10 an hour may not be a high wage, it is possible to live on this income with careful budgeting and financial planning. By prioritizing your spending and seeking opportunities for career development, you can work towards achieving your financial goals.

Frequently Asked Questions

What is the annual income for someone working part-time at $10 an hour?

If you work part-time at $10 an hour, your annual income will depend on the number of hours you work in a week. For example, if you work 20 hours a week, your annual income before taxes would be around $10,400.

How much is $10 an hour for 30 hours a week?

If you work 30 hours a week at $10 an hour, your weekly income before taxes would be $300. Your monthly income before taxes would be around $1,300.

Is $10 an hour considered a good wage?

The answer to this question depends on your personal circumstances. If you are a student or someone who is just starting out in the workforce, $10 an hour might be a good wage. However, if you have a family to support or live in an area with a high cost of living, $10 an hour might not be enough to make ends meet.