If you’re looking to calculate your hourly wage based on an annual salary of $75,000, you’re in the right place. Knowing your hourly rate is essential when budgeting and planning your finances, especially if you’re paid hourly or considering a job offer. With a yearly salary of $75,000, your hourly rate will vary depending on how many hours you work each week.

Assuming you work a standard 40-hour workweek, your hourly rate would be $36.06 per hour. However, if you work fewer or more hours each week, your hourly rate will adjust accordingly. It’s essential to have a clear understanding of your hourly rate to ensure that you’re being paid fairly and that you’re budgeting appropriately.

Convert $75,000 Per Year to Hourly, Daily, Weekly, and Monthly Salary

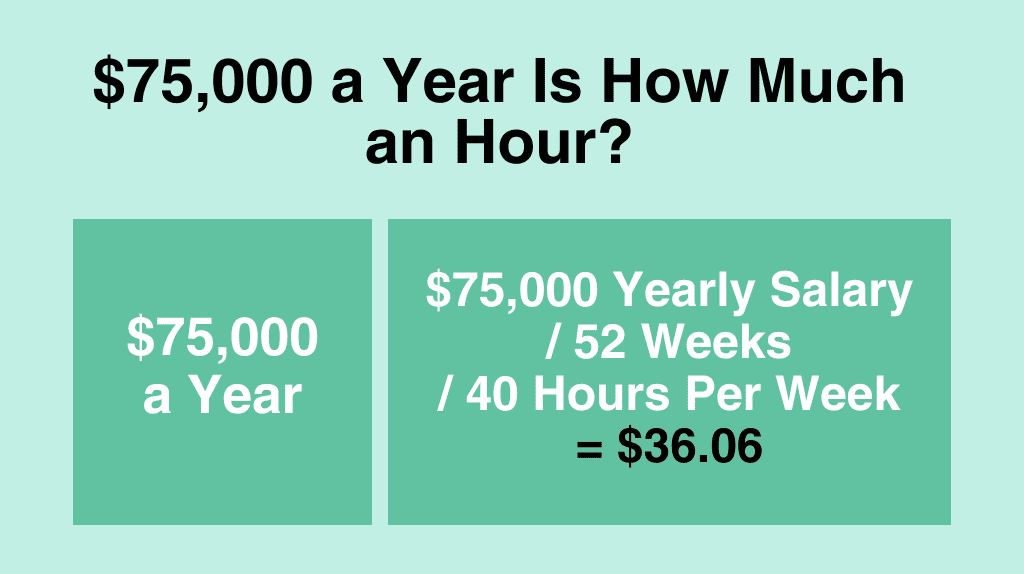

$75,000 Per Year is How Much an Hour?

If you make $75,000 an hour, your hourly salary would be $36.06. We calculate your hourly salary based on 8 hours per day, 5 days per week and 52 weeks in the year.

Annual Salary ($75,000) / Weeks Worked per Year (52) / Hours Worked per Week (40) = $36.06

$75,000 Per Year is How Much a Month?

If you make $75,000 an hour, your monthly salary would be $6,250. We calculate your monthly salary by dividing your annual salary by 12 months.

Annual Salary ($75,000) / Months per Year (12) = $6,250

$75,000 Per Year is How Much Biweekly?

If you make $75,000 an hour, your biweekly salary would be $2,885. We calculate your biweekly salary based on 52 weeks per year.

Annual Salary ($75,000) / Weeks Worked per Year (52) x Number of Weeks (2) = $2,885

$75,000 Per Year is How Much Weekly?

If you make $75,000 an hour, your weekly salary would be $1,442. We calculate your weekly salary based on 52 weeks per year.

Annual Salary ($75,000) / Weeks Worked per Year (52) = $1,442

$75,000 Per Year is How Much Daily?

If you make $75,000 an hour, your daily salary would be $288. We calculate your daily salary based on 5 days per week and 52 weeks in the year.

Annual Salary ($75,000) / Weeks Worked per Year (52) / Days per Week (5) = $288

$75,000 a Year is How Much an Hour After Taxes?

When calculating your hourly rate, it’s important to take taxes into account as they can have a significant impact on your take-home pay. After all, what matters most is how much money you actually get to keep.

Assuming a standard tax rate, your hourly rate after taxes would be around $28.94 per hour. This is based on an average tax rate of 22% for a single filer with no dependents.

However, keep in mind that tax rates can vary depending on your filing status, number of dependents, and other factors. It’s always a good idea to consult with a tax professional to get a more accurate estimate of your after-tax hourly rate.

Here’s a breakdown of how your $75,000 annual salary translates to an hourly rate after taxes:

| Time Period | Hourly Rate After Taxes |

|---|---|

| Hourly | $28.94 |

| Daily | $231.52 |

| Weekly | $1,157.58 |

| Biweekly | $2,315.15 |

| Monthly | $5,007.69 |

Remember, these figures are just estimates and may not apply to your specific situation. It’s always a good idea to do your own research or consult with a financial professional to get a more accurate picture of your after-tax income.

Is $75k a Year Good?

If you’re earning $75,000 a year, you’re making more than 76% of workers in the United States. However, whether or not $75k a year is good depends on a few factors, such as where you live and how you manage your finances.

Here are some things to consider:

Cost of living

The cost of living can vary greatly depending on where you live. For example, $75k a year might go a lot further in a rural area than it would in a big city. It’s important to consider the cost of housing, groceries, utilities, and other expenses when determining whether or not $75k a year is good.

Debt

If you have a lot of debt, $75k a year might not be enough to live comfortably. It’s important to factor in any student loans, credit card debt, or other outstanding balances when determining your budget.

Savings

If you’re able to live within your means and save a portion of your income each month, $75k a year can be a good salary. It’s important to have an emergency fund and save for retirement, so make sure to prioritize your savings goals.

Career goals

$75k a year might be a good salary for someone who is content in their current job and doesn’t have aspirations for a higher salary. However, if you have ambitious career goals, $75k a year might not be enough to get you where you want to be.

Whether or not $75k a year is good depends on your individual circumstances. It’s important to consider factors like cost of living, debt, savings, and career goals when determining whether or not $75k a year is a good salary for you.

Budget Plan for $75k a Year Salary

If you’re earning $75,000 a year, it’s important to budget your expenses wisely to ensure financial stability. Here’s a budget plan to help you manage your money effectively:

Determine Your Monthly Income

To create a budget, you need to know your monthly income. With an annual salary of $75,000, your monthly income is approximately $6,250.

Allocate Your Income

Allocate your income to different categories such as rent, utilities, groceries, transportation, entertainment, and savings. Here’s an example of how you could allocate your income:

| Category | Percentage of Income | Amount |

|---|---|---|

| Housing | 30% | $1,875 |

| Utilities | 5% | $312.50 |

| Groceries | 10% | $625 |

| Transportation | 10% | $625 |

| Entertainment | 5% | $312.50 |

| Savings | 40% | $2,500 |

Track Your Expenses

Track your expenses to ensure that you’re sticking to your budget. Use budgeting apps or spreadsheets to help you keep track of your expenses.

Adjust Your Budget

If you find that you’re overspending in a particular category, adjust your budget accordingly. For example, if you’re spending too much on entertainment, you could reduce your budget for that category and allocate more money to savings.

By following this budget plan, you can effectively manage your expenses and save money for the future. Remember to regularly review and adjust your budget as necessary to ensure financial stability.

How Can You Increase Your Income if $75k a Year is Not Enough?

If you find that earning $75,000 a year is not enough to meet your financial goals, there are several ways you can increase your income. Here are some options to consider:

1. Negotiate a Raise or Promotion

One of the most straightforward ways to increase your income is to negotiate a raise or promotion at your current job. Research the market rate for your position and experience level, and come prepared with specific examples of your accomplishments and contributions to the company. Be confident and professional in your approach, and be willing to negotiate to reach a mutually beneficial agreement.

2. Start a Side Hustle

Another option is to start a side hustle or freelance business in your spare time. This could include selling products online, offering your services as a consultant or coach, or starting a blog or podcast. Identify your skills and interests, and explore opportunities to monetize them. Keep in mind that starting a business requires time, effort, and often some initial investment.

3. Pursue Additional Education or Training

Investing in additional education or training can also help you increase your income. Consider pursuing a degree or certification in a field that is in high demand or that aligns with your interests and skills. This could open up new career opportunities and increase your earning potential.

4. Explore New Career Paths

If you feel stuck in your current job or industry, consider exploring new career paths that align with your passions and goals. Research industries and companies that interest you, and network with professionals in those fields. Be open to starting at an entry-level position and working your way up.

5. Invest in the Stock Market

Investing in the stock market can also be a way to increase your income over time. However, it is important to do your research and invest wisely. Consider working with a financial advisor or using a reputable online brokerage platform to make informed investment decisions.

Overall, increasing your income requires effort, persistence, and a willingness to take calculated risks. By exploring these options and finding what works best for you, you can take steps towards achieving your financial goals.

Conclusion

In conclusion, if you earn $75,000 a year, your hourly rate would be around $36.06 per hour. However, this rate may vary depending on the number of hours you work per week. If you work 40 hours a week, 50 weeks a year, then your hourly rate would be around $37.50 per hour.

It is important to note that while $75,000 a year may seem like a substantial amount, it may not be enough to sustain a comfortable lifestyle in certain areas, especially in big cities. Therefore, it is important to budget and plan accordingly to make the most out of your earnings.

If you are looking to increase your earnings, there are several high-paying jobs that can offer a salary of $75,000 or more. Some of the best jobs that pay $75,000 or more include software developers, financial analysts, nurses, and marketing managers, among others.

In conclusion, while $75,000 a year may not be the highest salary, it is still a respectable amount that can provide financial stability and security. By budgeting and planning accordingly, and perhaps exploring higher-paying job opportunities, you can make the most out of your earnings and achieve your financial goals.

Frequently Asked Questions

How much is $75,000 a year biweekly after taxes?

The amount of $75,000 a year biweekly after taxes would depend on the amount of taxes paid, the state of residence, and the number of exemptions claimed. However, assuming a standard 20% tax rate and claiming two exemptions, the amount of $75,000 a year biweekly after taxes would be approximately $1,923.

What is the monthly income for $75,000 a year after taxes?

The monthly income for $75,000 a year after taxes would depend on the amount of taxes paid, the state of residence, and the number of exemptions claimed. However, assuming a standard 20% tax rate and claiming two exemptions, the monthly income for $75,000 a year after taxes would be approximately $3,846.